How to Outsmart Your Competitors with Claims Data and Analytics

Presented by Emily Mortimer and Anja Maciagiewicz, LexisNexis at the 10x Medical Device Conference – San Diego 2019

Reading Time: 15 minutesAnja Maciagiewicz: I’m Anja Maciagiewicz. I’m a Vertical Solutions consultant working with MarketView. That’s all of our claims base products, and we’ll go into that a little bit in our presentation today.

Emily Mortimer: I’m Emily Mortimer. I’m the Director of Product Delivery and Analytics.

I also focus on all of our medical claims base solutions, having responsibility over the team that works on building those products and supporting our customers as they use the data solutions that we offer.

LexisNexis is really much more commonly known for being a really large legal database. There are a lot of spaces in which LexisNexis has a very large footprint, and healthcare is a more recent venue for them. So we wanted to just focus our presentation today on how LexisNexis makes a difference in healthcare.

Specifically, we’ll talk about:

- our claims-oriented solutions.

- claims adjudication,

- and how remitted claims or the claims remittance information can be impactful in your businesses today.

So the main focus we want to talk to you about today is all of our solutions oriented around reimbursement information.

The important thing here is to note that, in addition to a lot of the more commonly known medical claims oriented solutions that let you focus on provider volumes, understand where patients are being seen, things of that nature, what we’re also offering is a suite of solutions oriented to understanding payment.

So, that includes knowing things like what the variation of payment is across payers or across regions of the country. You can get at a lot of important information that helps you to market your products and helps you to understand the space in which you play and what providers are seeing when they go to use your products and eventually get reimbursed for that use.

Overview of LexisNexis

Anja Maciagiewicz: We work with insurance; with health care. We work with different government agencies. And we collect data. That is our bread-and-butter.

We collect data on everyone. Everyone in this room has what we call a Lex ID, and we get information from insurance records, bankruptcy records.

But drilling down into healthcare specifically, we are able to work with the top payers and health systems, the top 10 retail pharmacies, the top 20 life science companies, and we work with different federal and state agencies.

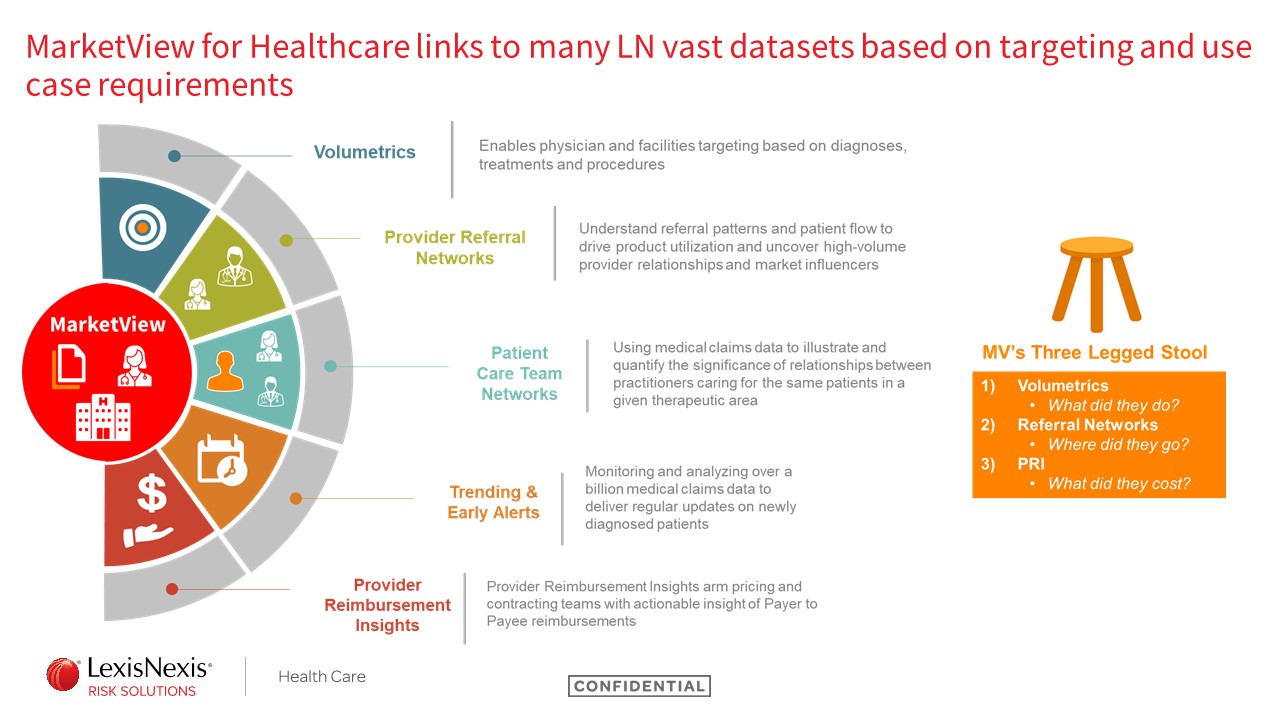

MarketView for Healthcare links to many LexisNexis vast datasets

So what is MarketView? That’s our claims-based products.

Within the med device space specifically, we have a “three-legged stool.” We have three different products that really help companies like med device companies, pharmaceutical companies, target and find the right people to talk to:

- Our volumetrics can tell you what a doctor does, what patients they see, and how many patients they see.

- Our referral networks can tell you where do these patients go, which doctors have a relationship with each other, and where do those patients go and get treated.

- Lastly is the remit data. So how much does a claim cost? How much did a payer pay out to a physician or facility for a certain procedure?

Looking at the broad level of the medical claims database we have, we have over 1.6 billion claims that we get annually. That equates to over a million practitioners that we have data about, over 400,000 organizations. And we’re able to update our data as frequently as daily, so we can give you near real-time information.

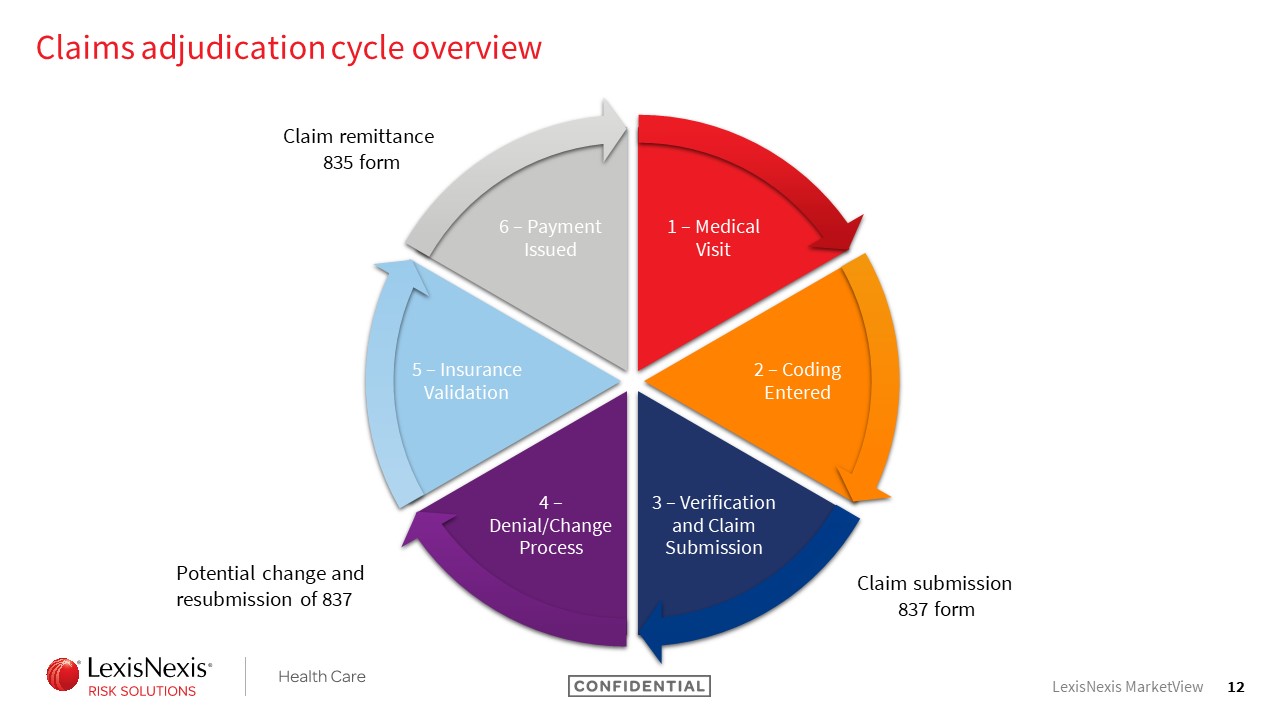

Claims Adjudication Cycle Overview

Emily Mortimer: I’m sure there are plenty in the audience who know a lot more about this process than I do, but we find that when we’re speaking with anyone about our solutions, it’s important to start with a few basics about medical claims, claims processing, and adjudication.

There are a lot of steps to the process. Most importantly, you start with the actual visit to the physician’s office and the adjudication cycle really summarizes how physicians go about getting paid for the services that have been rendered.

After the visit, typically, coding has entered. These days in the EMR system that’s a lot more real-time and helpful, but you often have coding review, things like that that happen in large facilities, like hospital systems will have nosologists who take a lot of responsibility for this work.

There will generally be verification and review of the claims done prior to submission. And at this point, a claim submitted to the company for payment is considered an 837 claim form. This is really just getting out the differences between the submitted and, eventually, the paid or remitted claim that you’ll be seeing.

Unfortunately, there is often a denial/change process that you will go through as a provider. So it might be that some elements on the claim just simply don’t line up and need to be resubmitted. If the patient’s gender is marked as male but some procedure like a mammography was done, you’re likely going to be asked more questions about that.

So, going through that process, potentially resubmitting the form, the insurance company finalizing and signing off on the validation, and payment being issued from that insurance company, at this point a new form is created and that’s really where we’re getting the insights for our Provider Reimbursement Insight solutions.

Another key part of what we do at LexisNexis has to do with the ways in which we acquire the data. So because we have this adjudication system, a lot of third-party companies exist – clearinghouses, switches, they’re typically called in the market – to help facilitate this process for providers so that you are not putting out a lot of your money from a provider perspective in this process. And it is through those clearinghouses and switches that much of the data we are going to talk about today is acquired.

Lastly, I just wanted to highlight a couple of key things.

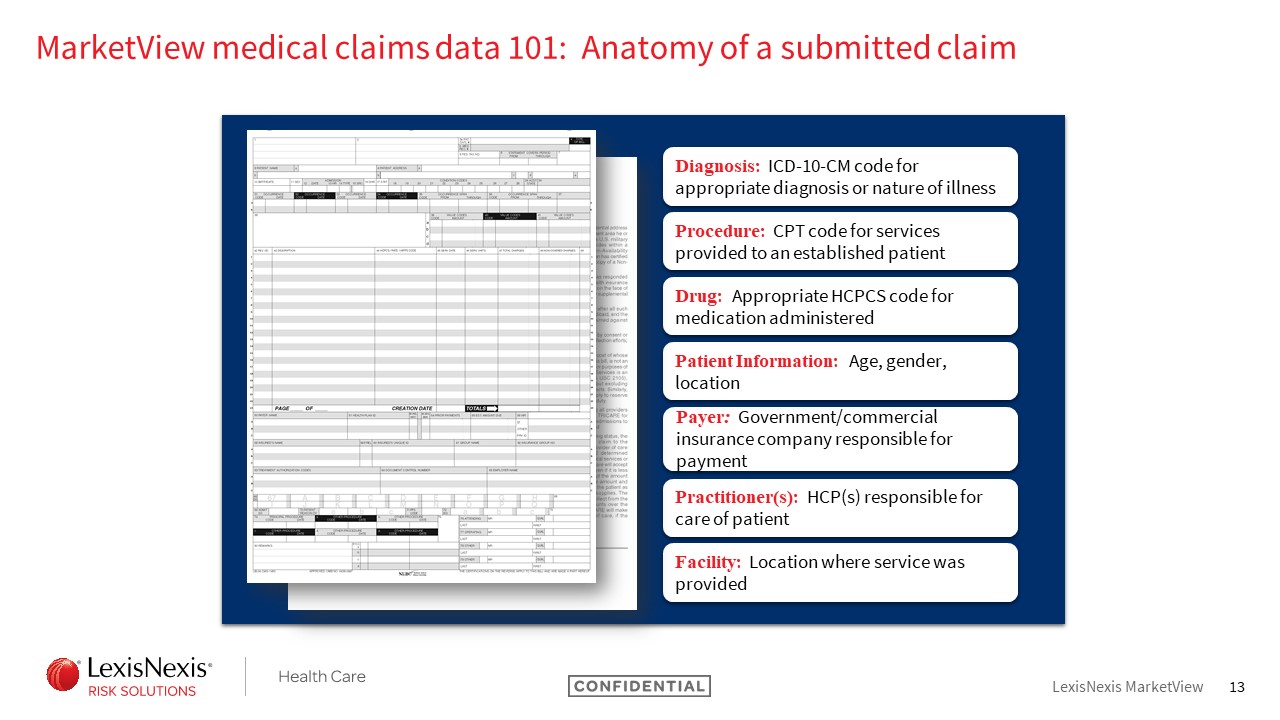

MarketView medical claims data 101: Anatomy of a submitted claim

Understanding what is present on a submitted claim is pretty important to the backbone of what solutions we can provide and, of course, also understanding what’s not present.

So a lot of the interesting things we’ve talked about around capturing data for medical devices or clinical notes from an EMR system, things of that nature are not going to be present on a medical claim because, in this case, it’s really dependent on what a provider needs to identify in order to be paid.

So pretty limited but you do access information about your ICD-10 diagnosis and procedure codes, CPT procedures if that’s relevant, a specific drug code or HCPCS code – in those cases you’ll have information about patient demographics to help to further differentiate your population if that’s of interest – and then information about payers, practitioners, and locations of care.

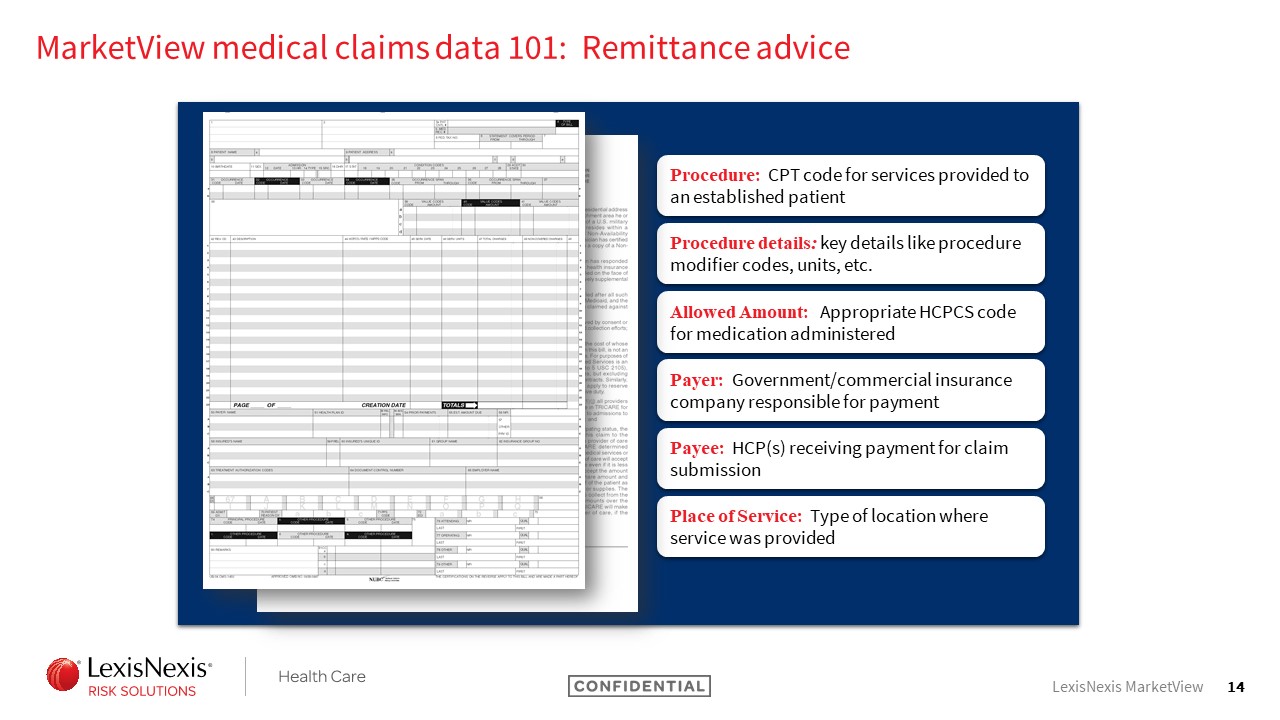

MarketView medical claims data 101: Remittance advice

On the remittance claim, which happens after the process of adjudication, you have access to a subset of those pieces of information in addition to additional information.

So you are still seeing what would be considered procedure line information, so CPT codes, because that’s really what you were getting paid out for. You’re not seeing diagnosis information. And now you also have access to the payer information that was provided. That includes the payer or insurance company. It also will include the amount that was covered for the claim.

MarketView Provider Reimbursement Insights

Anja Maciagiewicz: What kind of information do you get if you were to get our remitted product?

So high level we’re telling you the payer, if you paid out the claim, the average amount that was reimbursed and who got paid, whether it’s the facility or the physician. And this dataset, this product, has over 2,500 payers and over 550 million unique claims that make up all of this information we can pull for you.

Provider Reimbursement Insights use cases

So why would this be valuable for a company, specifically a medical device company?

The most common use case is actually being able to figure out the return on investment. So if you had a piece of equipment you’re looking to rent or buy in an office, looking at how much you get remitted or how much you get paid every time you submit a claim can help you figure out how many times do you have to submit that claim to start seeing a return on your investment, when do you start making a profit.

We can also help with competitor pricing, so being able to create pricing models to stay competitive, monitor and respond to market changes, and providers can figure out how to get the maximum reimbursement. They can do this by using the modifiers or place of service on a claim form.

Lastly, it can help with contract negotiations. So, being able to look at what different payers and facilities are paid and figuring out how to use that for your pricing and contracting strategies.

Emily Mortimer: For anyone who has previously or goes on to work with us, one thing that you will learn is that we really like to tell the story of what our data can help you do, but we find that it’s most impactful if we can really demonstrate it by showing you the numbers themselves.

We pulled together, in support of some of those use cases Anja mentioned, actual samples of the data solution that you would see in order to help really clarify what you can see.

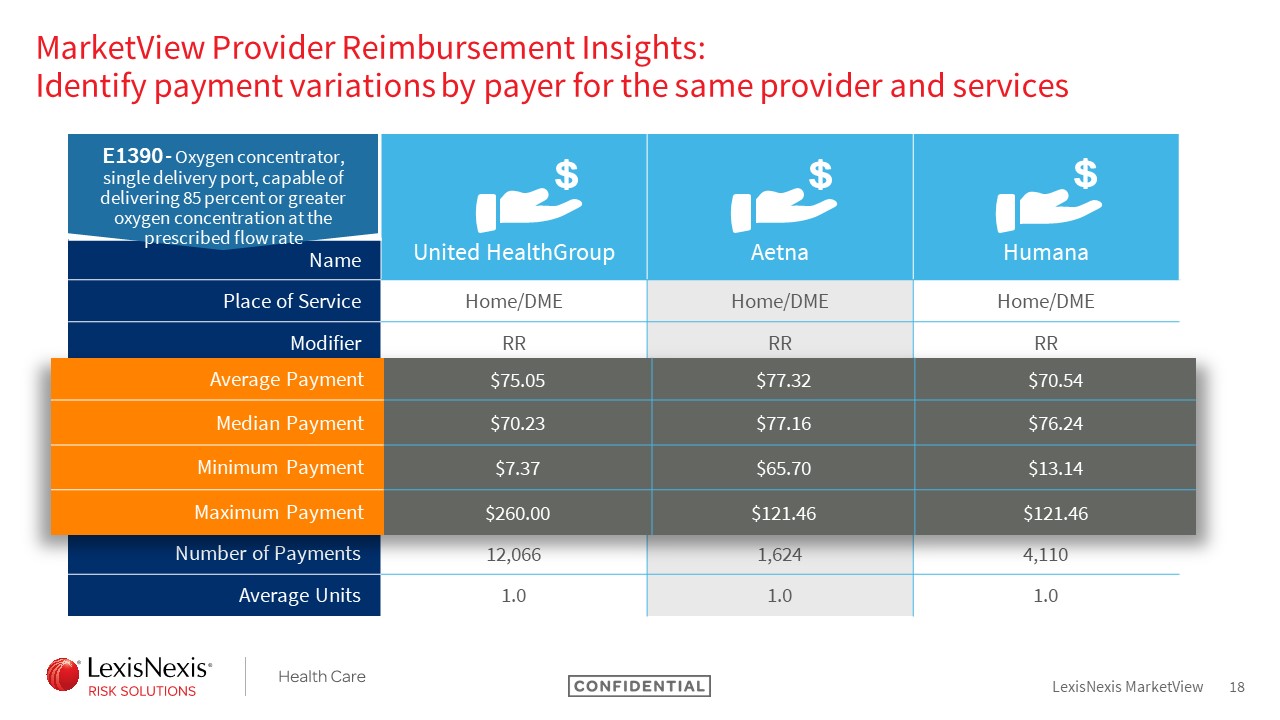

So, in this case, we are looking at the remitted claims solution data points. Specifically, for an oxygen concentrator code. And in this case, it is a product that is generally supplied through HME or DME companies to the patient in their home.

It’s a known product in the market. This isn’t something where I would necessarily go in anticipating significant differences in how things are paid because it’s been around for quite some time.

But you can see here that, when we look at this across payers, you do see variation. Specifically, I would call your attention to the median payment amount where we’ve done the work to control for outliers on the both high and low ends. And you can see we are still seeing, even between United Health and Aetna where you have two private payers, a jump of $7 in terms of the median remitted payment likely back to the HME supplier.

On a single case that might not seem that significant, but you can imagine how that scales up and has a pretty significant impact on what’s being reimbursed.

Again, you can see a number of other data points here that Anja mentioned. I’ll just call out for clarity. So we do report out things like the modifiers so you can ensure you’re holding consistent for how the product is used – whether it’s rental of a piece of equipment versus purchase of equipment, in which case, obviously, the price would be significantly different – to really give you the insight into how those various factors impact reimbursement.

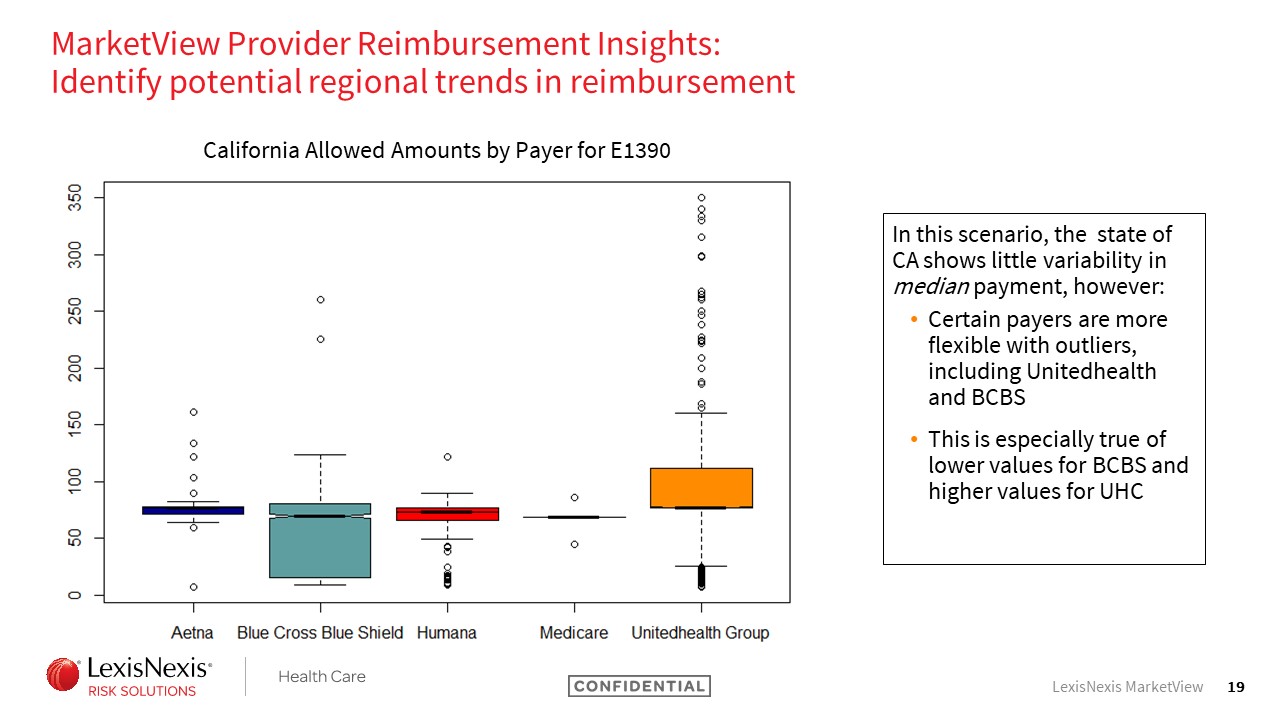

Moving forward, we wanted to talk a little bit more at a high-level. So, in this case, we’re looking at the ways in which the median payment varies in its very broad regions.

So this is across the entire state of California. And we’re looking at the same product here, looking at not just where does the median shift but what is the range of payment accepted across these different payers.

So let’s go straight forward to Medicare where you can see there’s almost no range. Medicare, we all know. They’ve defined their payment plan and, in this case, they stick to it. Good to see they’re consistent but not really a surprise.

But you look at something like Blue Cross Blue Shield and you see the variation in payment is really significant. So you’re looking at payment amounts that can be as low as about probably $20 and, even ignoring the outliers for a moment, if you look at that third quartile, we’re talking about payments nearing $100.

So this information alone isn’t going to tell you why you see that variation, but it is an interesting thing as you think about your contract negotiations because you want to understand what’s going to be an acceptable range for those different payers.

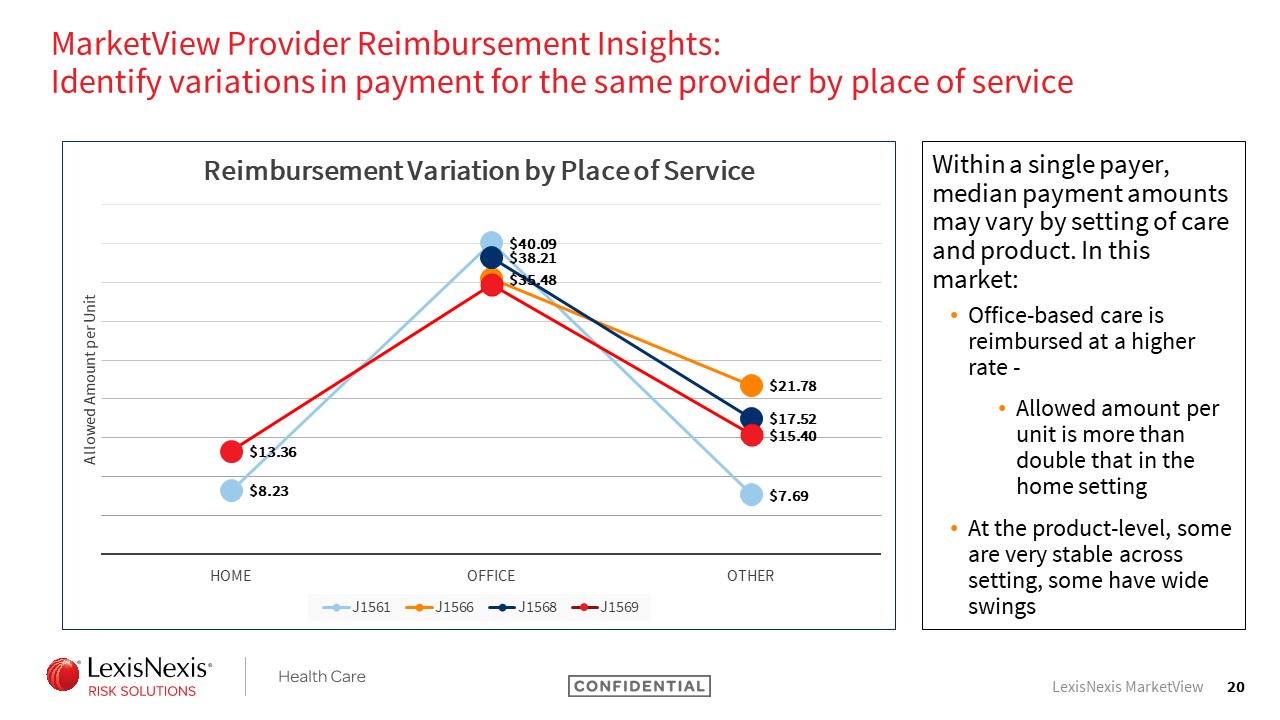

Another piece of information that can really impact the payment reimbursement information is setting of care.

So, in this case, we’re looking at a set of codes that are all pretty specific and similar to each other. You might consider them biosimilars. These are for blood products in the IG space, and all of them have use cases that vary in different settings of care.

What’s interesting is, even where two products can be used in the same setting of care for normal purposes that are approved, the payment can vary. So, in this case, you see that for one product. J1561, its median payment in the home setting or HME is only around $8, whereas a competitive product has a medium payment of $13.

Again, these are not hundreds of dollars different but scaling them up makes a pretty significant impact on how they’ve been used.

The office setting, you don’t see quite as big of a jump between two single products. But, from the low end to high end, you similarly see a jump of about $5. It’s really interesting to see that play out.

And the other thing to note here because these are infused products is, these median rates do hold units consistent. So this is not being skewed by the fact that one product might require more units to be infused than another product.

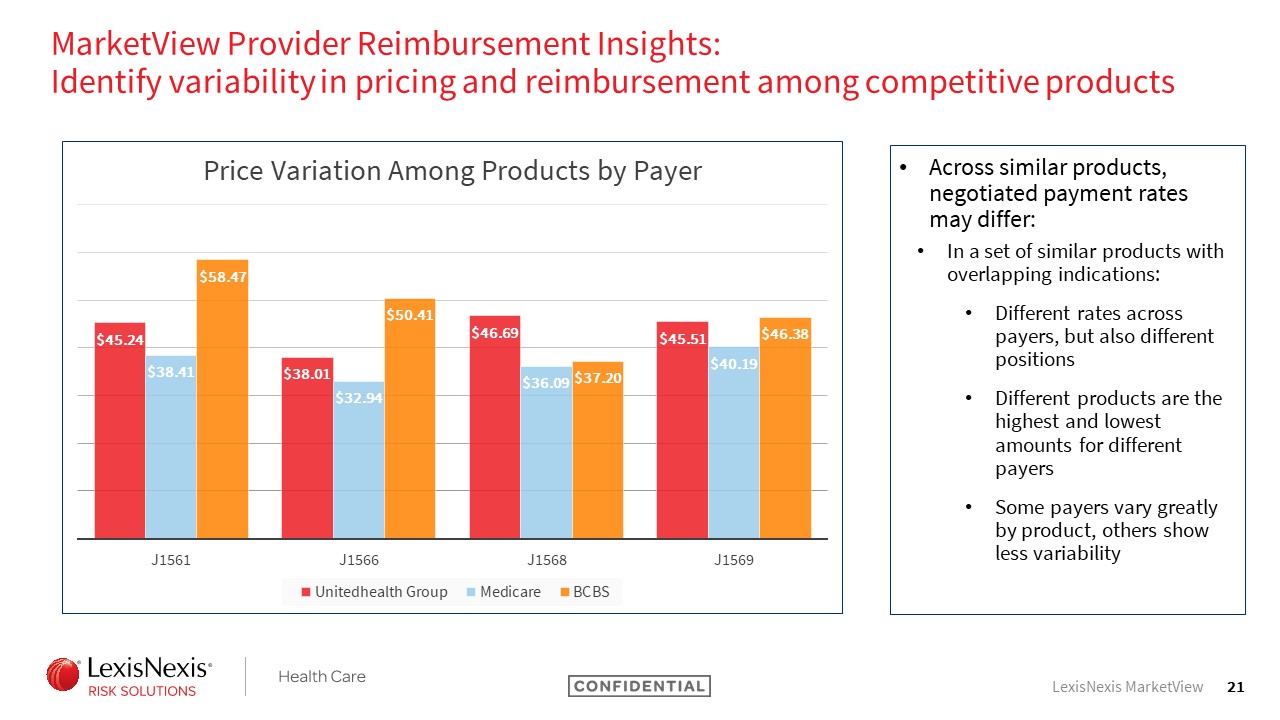

Using that same set of codes again, here we’re looking at the ways in which the payer differs by product.

So you can see that, for a single product, payment variation happens between payers. And you can even see across the payers.

So looking at the fact that – UnitedHealth Group is red for all of these products – the lowest payment for them is a code that is a higher payment for Blue Cross Blue Shield.

So it’s interesting to see that the same pattern doesn’t even hold true – so it’s not that United always pays the most – and it differs by the products.

Summary

So we wanted to make sure we left some time for questions. I think the most important thing here is to think about how this could be used for you guys and your market.

So we talked about being able to use this for an ROI calculator. That’s certainly something that providers can do themselves as they think about capital expenditures.

It can also be a part of a medical device company’s marketing effort to say, “We know that your return on an investment will become clear after X utilization of this product.” I think it’s a powerful way to be able to bring that message to bear in addition to what medical device companies will do to negotiate with payers and be a part of marketing their product more broadly.

Q&A

Joe Hage: I have a question. How does the typical account respond when you come in and say, “I know all this detail about you”?

I know if somebody gave me that level of detail about me before I met them it’d be a little creepy.

(laughter)

Emily Mortimer: Really, in this case, it varies a lot by vertical.

We play with med device companies, with pharma companies, and also a lot in the provider space. When you go to a hospital system and you tell them what you know about them, they mostly just want to tell you you’re wrong. They know everything about themselves.

What we know about them is complete, it is comprehensive, it allows for competitive intelligence. But we said, “There are 19 procedures done with this J code,” and they actually have 20, so they’re going to point that out.

When it comes to speaking with pharmaceutical and med device companies in general, it’s more around having a strategy conversation. So we’re not saying what we know about you as a medical device company or what we know about you as a pharmaceutical company. We’re saying what do we know about the landscape in which your devices and your products play; how can we help you to focus your efforts and energies in the right place, make sure you’re using your resources, and make sure that you’re telling a really good story to all of the providers and the facilities that you’re working with.

Joe Hage: Tell me how you actually help people integrate this data into their processes.

I can imagine one group made the decision to bring you in. It might be the marketing side; it might be the sales side. Getting them in the same room, talking off the same playbook, I imagine that’s challenging. How do you go about it? How successful has it been?

Anja Maciagiewicz: A lot of times it’s the people going out to find the doctors, who are they targeting. But also a lot of the pricing groups. So how do we know what to price this device at or how do we price this drug? How can we compare that to our competitors that might be on the market?

I think people see this product and know it can be helpful, but people are scared to dig into the pricing a little bit. They wonder, “How do you have this information? Are you allowed to share it?” We are, and for our clients who have used it, they definitely have gotten a lot of value out of it.

Emily Mortimer: One other thing I would just say about that is bringing the people together.

Depending on the scope of the engagement, it can vary a lot. So we may or may not need to bring IT resources to bear to really load and process data.

It might be that the data set someone’s interested in is small enough to put into an Excel file and it can be worked by a single analyst and it’s not a really large enterprise-wide solution, but there are certainly engagements we do where we do have an entire implementation team and we want to ensure we’re focused on ways to build up a relationship that’ll be sustainable, that will make utilizing data over time easy and consistent and not too resource-intensive for our customers.

Joe Hage: Thank you.

Sarah Wright: Hi, my name is Sarah Wright.

I really like the collection and treatment code data and I understand you can’t have identifiable patient information, but how deep does that demographic data go? No information about the patient’s name etc, but can you see repeatable data sets? Or can you see when someone presents and needs these treatment codes?

I’m just more interested in how do you put all that together in terms of repeatability and being predictive and proactive.

Anja Maciagiewicz: I’m thinking of some of our additional products that I mentioned in the beginning – some of our volumetrics. We’re able to figure out when a patient may have come in for CPAP but also had COPD.

So we can look at a history. We can see what the patient has had, whether it’s been on the same claim or has it occurred within the past 12 months. We call that a co-occur with our volumetric data.

For the remit data, I’m not sure.

Emily Mortimer: So what Anja’s discussing is really related to the fact that, while all of our data is de-identified, we do have a unique patient identifier attached to the claim.

So we can look at things over time. There are various ways we can put solutions together that look at those different criteria.

From a remitted solution perspective, most of what we are doing right now is not as much patient-cohort related. Part of that is because what we are leveraging here is just the reimbursed claim by itself – the ERA a lot of folks call it – and we do not yet link it back to the submitted claim.

That’s really the next phase of this product, to say, “Now that we have linked to those two claims together, we have all that patient demographic information. We have the diagnosis information on those patients, and we’ll certainly be building robust solutions like that in that product line the future.

Gunter Wessels: Are you able to do some trending across reimbursement by payer and so forth?

Emily Mortimer: Mhm.

Gunter Wessels: How about switching between different modalities like lithotripsy to laser in urology?

Emily Mortimer: I think that it’s going to be a little bit dependent on what the indicators are for the modality switch. For a lot of those things it’ll be based on the modifier, so we would have access to that and could look at it overtime or for a specific provider. But it’s just going to depend on how that’s coded on the claim.

Alex Gerwer: Two quick questions.

One of the things that surprised me was when IMS was acquired, not by you folks, and then brought into IQVIA. Do you interface with drug data from IMS?

Then, the second part, are you folks making any efforts to work with some of the major EMR vendors to get clinical data to correlate with claims data?

Emily Mortimer: We absolutely work to partner with other vendors who have access to drug data.

We do not specifically partner with IQVIA. There are absolutely reasons why their DED data is very strong, but we have great partnerships that can help solve that problem. We don’t have the prescription data in-house ourselves.

In terms of the EMR, there are conversations we continue to engage in around ways EMR data can be helpful and be impactful in our products. It may or may not be related to a volumetric-type solution. Some of what we’re actually looking at are almost other investigations and other analyses. Things like patient clustering, pre-diagnosis for a rare disease state, or something like that where the clinical notes are really informative in the absence of a diagnosis.

But those are all in the nascent stage. I wouldn’t say we have an offering in that space.

Joe Hage: I’d point out that the folks in this room are a microcosm of the folks watching in TV land. So if these questions are an indication, there’s a lot of interest in how to use data to be smarter about going to market.

So Anja and Emily, thank you so much for joining us.

(audience clapping)

Recent Comments